Retire from UNI

UNI is thankful for the years of service provided by eligible retirees and is proud to provide continued benefit options to assist in a smooth transition to retirement. Contact the HRS Benefits Team at hrs-benefits@uni.edu or call 319-273-2423 for questions or to set up a meeting regarding retirement benefits.

Retirement Eligibility

Employees must be 55 years of age or older and have 10 or more years of non-temporary, active service.

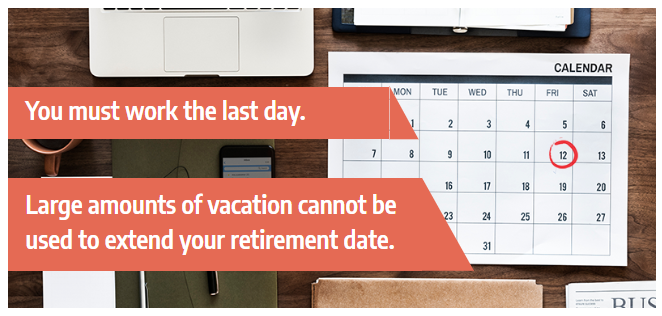

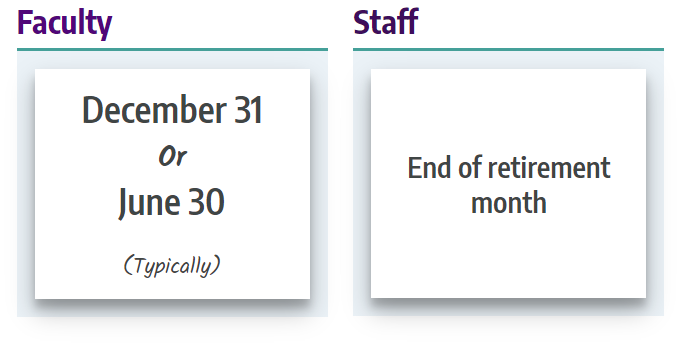

Date of Retirement

Staff

Staff must retire on a working day (non-holiday) and must work on their last day of employment. Staff may not use vacation on their last day or use vacation to extend their retirement date.

Faculty

Faculty retiring at the end of the fall semester will normally use a December 31 retirement date. For a spring retirement date, faculty will normally use a June 1 retirement date.

Summer and Winter Appointments

If a faculty member is retiring following a summer or winter appointment that is for teaching specifically, a retirement date of 3 business days after the end of the summer appointment should be used to allow for 3 days for grading. For faculty summer or winter appointments that are not for teaching, the retirement date would coincide with the last date that the activity ends.

Examples:

- Faculty member summer appointment is for teaching the July session that ends July 30, the retirement date would be three business days following the end of the summer appointment.

- A faculty member is assisting with summer internships that ends on August 5, the retirement date would be August 5.

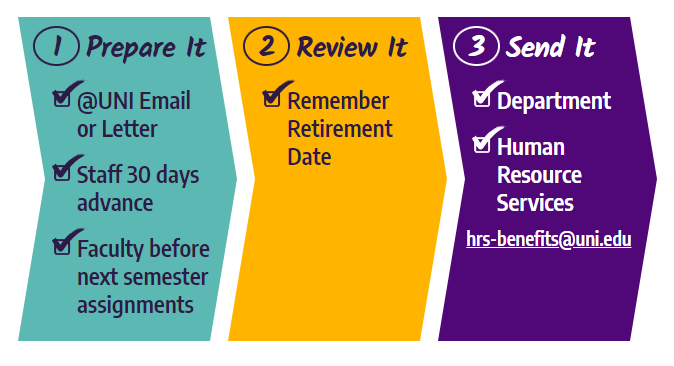

Notice of Retirement

Staff are asked to provide 30 days notice of retirement. Faculty are asked to notify their department head and/or dean before class assignments are made for the upcoming semester. A retirement letter should be provided to your supervisor/department head, and a copy provided to Human Resource Services. The letter should be dated, provide a date of retirement, and signed. If the retirement letter is in email it should be sent from the employee’s uni.edu email address. It can be emailed to hrs-benefits@uni.edu or mailed to 027 Gilchrist Hall, 0034.

Phased Retirement

Faculty and Staff that have entered a phased retirement agreement must retire at the end of their phased retirement agreement. No additional notice is required unless the faculty or staff member wishes to end their phased retirement agreement early. In this case a retirement letter will be required.

Emeritus Status

Administrators, Faculty and P&S employees who have a minimum of 20 years of creditable full-time or part-time service in higher education including a minimum accumulation of 10 years of service at the University of Northern Iowa may apply for Emeritus Status. Faculty must have at least 10 years of meritorious service at UNI.

Interested Faculty and Staff should complete the form once eligible and when a retirement date has been established. Status completion is subject to all levels of approval and may require several months to complete.

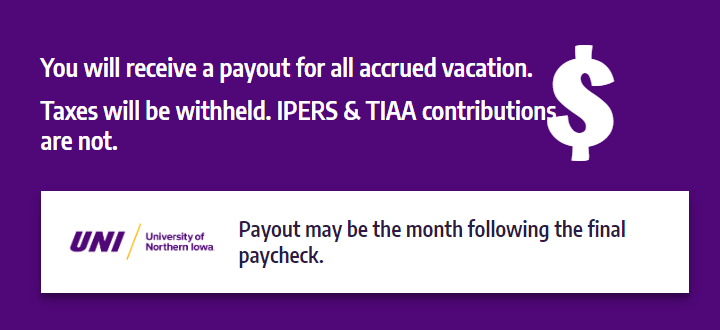

Vacation and Sick Leave Payout

Vacation

All accrued vacation is paid out in full, with the total hours of accrual multiplied by the hourly wage.

Sick Leave

Sick leave is paid out to a maximum of $2,000 per Iowa Code, with the total hours of accrual multiplied by the hourly wage. Both vacation and sick leave payouts are typically made with the final paycheck. However, it may need to be paid out the month following retirement depending on the retirement date, form completion, and processed timecards.

Employer Paid Benefit Coverage

Employer paid coverage for health, dental, and vision will end the last day of the month in which you are retiring. Contributions to the university sponsored TIAA retirement plan will cease upon final payouts. Employer paid life and long term disability Insurance will end on the last day worked. New health, dental, and/or Medicare and Medicare supplements should begin on the first day following the month in which the employee retires.

Benefit Options in Retirement

Health Insurance Options | Age 55 - 64 | Age 65+ |

|---|---|---|

Healthcare.gov | ✔ |

|

Spouse/Domestic Partner's Health Plan | ✔ | ✔ |

UNI Comprehensive Health Insurance Plans | ✔ | ✔ |

Medicare Supplement & Medicare Part D |

| ✔ |

Medicare Advantage |

| ✔ |

Wellmark Blue Cross Blue Shield Medicare Group Program F |

| ✔ |

Group Prescription Drug Plan |

| ✔ |

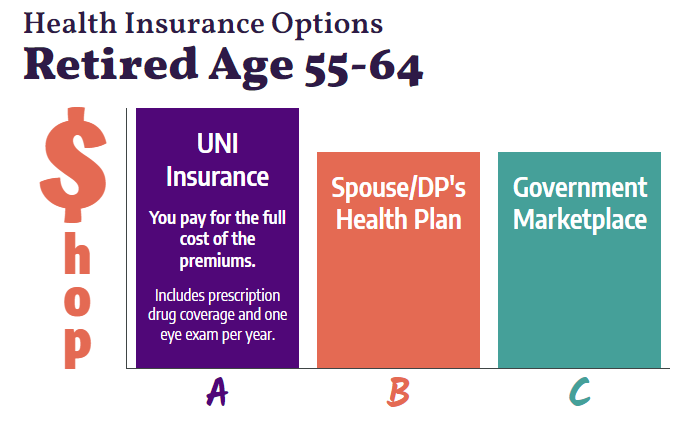

Age 55-64

Access

Health & Dental Insurance

Same plans, you pay for the full cost of the premiums.

Vision Coverage

Delta Dental DeltaVision® Discount Program

Retirees enrolled in Delta Dental of Iowa are automatically eligible for the vision discount program with DeltaVision® by EyeMed at no extra cost.

Present your Delta Dental ID at a participating provider to take advantage of the following features:

- Discounts on eye exams

- Discounted pricing for lens and lens options

- Savings on eyeglass frames and conventional contact lenses

- Unlimited use

- Discounts on LASIK and PRK

- Competitive pricing on contact lenses through Contact Lens by Mail

- Access to a large, diverse network of providers

To take advantage of this discount, simply locate a DeltaVision® provider by calling 866-559-5252 or visit the DeltaVision® website. When you schedule your appointment inform the office that you are a Delta Dental member with a DeltaVision® discount plan. Once you arrive at your appointment, present your Delta Dental DeltaVision® ID card to receive the discounted services.

Additional Health Care Options Before 65

Retirees who decide to waive coverage through UNI may continue coverage through a spouse/domestic partner’s health plan. Enrollment in plans through healthcare.gov is another additional option. Retirees may also choose to work with an insurance broker to obtain and purchase additional coverage options.

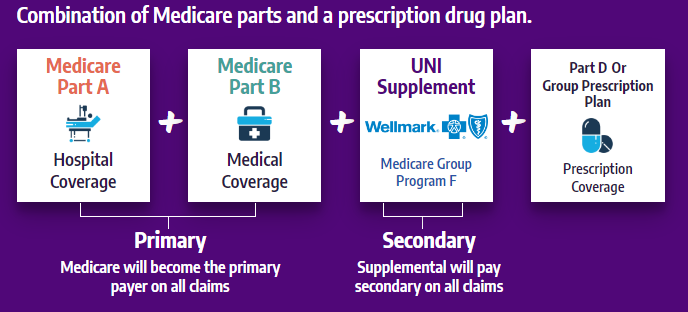

Age 65+

Medicare in Retirement

Retirees age 65 and older will need to enroll in Medicare Part A (if not already enrolled) and Part B. To enroll in Part B without penalty, retirees should work with Human Resource Services in completing an application and affidavit using Social Security form number CMS-L564. Human Resource Services must sign the affidavit. Medicare becomes your primary insurance in retirement.

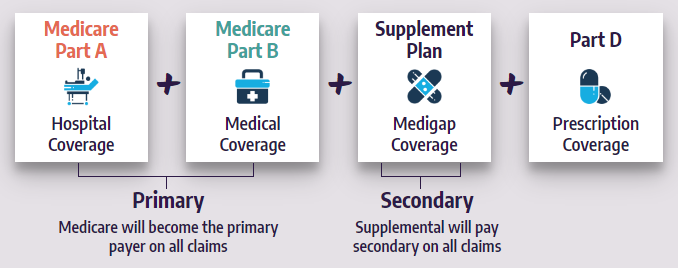

Medicare will become your primary health insurance in retirement and covers approximately 80% of all health care expenses in retirement. To provide coverage for the 20% that Medicare does not cover, retirees may elect the Wellmark Blue Cross Blue Shield Program F, Medicare Supplements available in the marketplace, or a Medicare Advantage plan (if eligible).

When enrolling in the Wellmark Blue Cross Blue Shield Program F, a Medicare Supplement plan, or a Medicare Advantage Plan retirees will also want to consider a prescription drug plan. UNI also offers an optional group prescription drug plan through Wellmark. There are many prescription drug options available in the marketplace, along with Medicare Part D.

Access

- Social Security (SSA) or call 888-456-9554

- Senior Health Insurance Information Program (SHIIP) or call 800-351-4664

- Medicare or call 800-633-4227

- Medicare and You Handbook

65+ Health Insurance Options

Option 1

Option 2

Option 3

Medicare Advantage

A type of Medicare health plan offered by a private company that provides all of your Part A and Part B benefits.

- Most Medicare Advantage Plans offer prescription drug coverage.

- Medigap policies can't work with Medicare Advantage Plans.

Things to Consider

Plan Comparison Considerations

- Premiums

- Network

- Deductibles

- Co-pays

- Coinsurance

- Prescription Drug Costs

- Maximum Out-of-Pocket

- Maximum Out-of-Pocket costs for prescriptions

Ending Coverage

Employees may end UNI comprehensive coverage for health, dental, Group Program F, or Group Prescription Drug coverage at any time. Waived coverage will end the last day of the month you are ending coverage. New coverage should be effective the first day of the following month in which the coverage ended. Once coverage is ended you may not re-enroll at a later date. If you end coverage, coverage on spouses and dependents will end at the same time.

External Benefit Options

Iowa Retired School Personnel Association (IRSPA)

An IRSPA membership provides access to supplemental retiree benefits through Association Member Benefits Advisor (AMBA). Among the benefits offered are dental and vision plans. Learn more at irspa.org.

New Dental Choice

Principal Financial is offering a membership dental discount plan called New Dental Choice. This gives you immediate discounts for dental procedures at participating dentists. Learn more at NewDentalChoice.com

COBRA

UNI is required under federal law to offer covered employees and their covered family members the opportunity to temporarily extend group coverage of health, dental, vision, and health care flexible spending accounts.

Life Insurance

Life insurance coverage ends the day following retirement.

Retirement Income

TIAA

If you are retiring after age 55, you have several options for your TIAA contributions.

- If you retire after reaching age 55, the additional 10% early withdrawal penalty will not apply.

- There are numerous withdrawal options to choose from including rollovers, withdrawals and annuities.

- For more details, visit the TIAA website, schedule an appointment with a TIAA consultant or meet with your financial professional.

TIAA Retirement Income Consultants

Understanding how to manage your retirement income can be confusing, but you don’t have to navigate this important decision alone. Financial Consultants and Retirement Income Consultants at TIAA are available to help you create a sustainable retirement income strategy using your TIAA accounts and other resources. The Retirement Income Consultant team offers a differentiated planning experience by focusing on:

- Income Options

- The consultant team will analyze your full household financial situation.

- Invested Appropriately

- Discuss the key risks you may face in maintaining your quality of life throughout retirement.

- Personalized Advice*

- Meet with a specialist to develop an income plan tailored specifically for your personal situation and goals.

- *Advice is obtained using an advice methodology from an independent third-party.

Schedule a meeting with a TIAA consultant by visiting tiaa.org/schedulenow, or call 800-732-8353.

IPERS

If leaving employment and you qualify for retirement contact IPERS (800-622-3849) to discuss your benefit estimate, purchasing service and restrictions with working after retirement.

IPERS also offers a free webinar entitled Ready to Retire? An Overview . This webinar will discuss the benefit formula used, how to read your estimate, how to purchase service and restrictions if you are planning on working after retirement. You may attend a live one-hour session or they do offer a pre-recorded version for you to view 24/7. Visit https://ipers.org/journey-retirement/education for more information.

Eligibility for Monthly Retirement Benefits

- A vested IPERS member.

- Age 55 or older.

- Eligible for a monthly benefit of at least $50.

Retirement Tax Law

Consult with your tax advisor regarding regulatory changes to retirement plan savings and distributions. Iowa House File 2317 provides tax relief for certain retirement incomes as well as other income tax bracket adjustments. Now is a great time to meet with your financial advisor, or an IPERS or TIAA consultant, to see how the changes may impact your income and savings plans. An online request for tax guidance is also available through the Iowa Department of Revenue.

Retirees Returning to Work

If a retiree returns and is eligible for benefits, they can either:

- Select the active employee benefits and waive retiree coverage

or - Waive the active employee benefits and continue with the retiree benefits.

An employee can only retire from UNI once. Once the retiree coverage has been waived, the retiree cannot re-enroll in retirement coverage.

TIAA

- If a retiree returns to work at UNI, and previously participated in TIAA, they cannot return in a TIAA eligible position and continue to contribute to TIAA while receiving distributions.

- If the retiree is now participating in IPERS they cannot hold a non-temporary appointment at the university and receive TIAA distributions.

IPERS

- If a retiree returns to work, and previously participated in IPERS at UNI or another state agency, they cannot receive IPERS distributions if they earn an annual salary of $30,000 or more at any state agency.

- It is necessary to establish a clear separation from IPERS-covered employment after retirement for retirees age 55-70.

- This includes not allowing a retired member from becoming an independent contractor for their former IPERS-covered employers during a bona fide retirement period.

- For more information on retirement restrictions with IPERS members returning to work, please visit the IPERS website.

Independent Contractors

- An employee may not return to work as an independent contractor during the bona fide retirement period.

- The employee may not enter into a written or oral agreement to perform services as an independent contractor until at least one benefit payment has been received from IPERS.

IPERS Update Effective July 1, 2023

- IPERS retirees can work as an independent contractor for, or work in a non-IPERS-covered position with, an IPERS-covered employer after receipt of one retirement benefit payment.

- Retirees can also enter into a written or verbal agreement to perform services as an employee, independent contractor or volunteer for an IPERS-covered employer after receipt of one retirement benefit payment. The previous requirement was four months. Returning to work information for retirees is available on the IPERS returning to work webpage.

Retiree Contact Information

Please ensure your personal contact information is up to date with Human Resource Services. Benefits-related communications are always sent to the last known address we have on file.

To request updates to your personal contact information, contact the HRIS Support Team at hris-support@uni.edu.

Important Contacts

SHIIP

Social Security

- 800-772-1213

- www.ssa.gov

What Should I Do Next?

Learn more about important steps to guide you years, months, and days leading up to your retirement.

Frequently Asked Questions

- 1Q: Will I receive a payout for my sick leave once I retire?

1A: Per Iowa Code, if you are over the age of 55, you are eligible to receive a payout of your unused sick leave up to a maximum of $2,000. The total payout will be the number of hours accrued on the date of retirement multiplied by the hourly wage rate up to a maximum of $2,000.

- 2Q: What happens to my health and dental insurance after I retire?

2A: If you are age 55 of over when you retire, you will be able to continue your health and dental insurance for life, if you choose. Currently the surviving spouse of a UNI retiree is allowed to continue coverage unless they are eligible for another employer group plan. You are responsible for the full premium payment to Wellmark and/or Delta Dental.

- 3Q: When will my employer paid health and dental coverage end when I retire?

3A: Coverage will end on the last day of the retirement month.

- 4Q: What happens if I retire and then return to work at the university?

4A: You may only retire once from the university.

- 5Q: If I don't elect to continue health or dental coverage at the time of retirement, can I enroll later?

5A: If you discontinue (waive) either the health or dental plan, you cannot enroll later.

- 6Q: Do I have to wait until I am retired to apply for Emeritus status?

6A: No, you can apply once you are eligible and know your retirement date. Emeritus status will not be added to your UNI record until you have a separation of employment (e.g. retirement).

- 7Q: Am I required to include a letter of recommendation to apply for Emeritus status?

7A: A letter of recommendation is not required for staff. For a faculty member’s application, a letter from the nominee’s Department Head or College Dean, or their designee, is required to be submitted to Senate leadership.

- 8Q: If I elect to maintain UNI comprehensive coverage, can I change coverage to Program F?

8A: Retirees 65 and older may elect to change to Program F during open enrollment. They may also elect to change during a qualifying life event (e.g. change in eligibility due to recently turning 65).

- 9Q: If I waive UNI comprehensive coverage when I retire can I later enroll in the Program F?

9A: Retirees must continue UNI comprehensive coverage when you retire or enroll in the Program F to maintain coverage with UNI. Once coverage is waived you can not later re-enroll in either comprehensive or Program F.

- 10Q: How will I receive my final payslip after I retire?

10A: Your final payslip will be mailed out to the address that we have on record for you.

- 11Q: How will I receive my W2 and/1095C (if applicable)?

11A: These documents will be mailed to the address on file once they are updated and become available.

Wherever conflicts occur between the contents of this site and the contracts, rules, regulations, or laws governing the administration of the various programs, the terms set forth in the various program contracts, rules, regulations, or laws shall prevail. Space does not permit listing all limitations and exclusions that apply to each plan. Before using your benefits, review the plan's coverage manual. Benefits provided can be changed at any time without the consent of participants.