The Patient Protection and Affordable Care Act (ACA)

The Affordable Care Act (ACA) was passed by Congress and then signed into law by the President on March 23, 2010. On June 28, 2012 the Supreme Court rendered a final decision to uphold the health care law. This comprehensive health care reform law aims to expand Americans' access to affordable health care insurance.

ACA requires large employers, like the University of Northern Iowa, to offer health insurance coverage to substantially all (at least 95%) of their full-time employees. Additionally, the ACA requires the University to complete complex annual IRS reporting. These requirements make it critically important for the University to be able to track hours for all employees.

Note: Any hours worked outside of the United States do not need to be used when determining ACA full-time status.

ACA Impact

How Does ACA Impact Non-Temporary Employees?

The existing health benefits meet the ACA's requirements for affordable employee coverage and benefit value. In addition, the University’s health insurance eligibility requirements for non-temporary employees exceed ACA requirements because we offer coverage if the employee works half-time or more. If a non-temporary employee working 30 or more hours reduces their schedule to less than 20 hours a week, they will be offered our ACA UNI Blue HMO single and family plan.

How Does ACA Impact Temporary Employees?

This group includes: temporary faculty (adjunct), graduate assistants, Merit temporaries, P&S temporaries, seasonal, and students employees (non-work study assignments). ACA regulations require we offer health insurance to all temporary employees, including student employees who meet ACA eligibility requirements.

Employee Types

- Full-time Employee – Under the ACA, an employee working 30 or more hours a week, or averages 130 hours a month, is considered full-time. A new employee who is reasonably expected to work full-time (30 hours or more per week, including on-call hours) at his or her start date for a period of 90 calendar days or more is considered benefits eligible based on ACA rules. Excludes work-study assignments.

- Part-time Employee – Under the ACA, an employee working less than 30 hours a week, or averages less than 130 hours or more a month, is considered part-time. Excludes work-study assignments.

- Variable Hour Employee – An employee is considered a variable hour employee if, based on the facts and circumstances at the start date, it cannot be determined the employee is reasonably expected to work on average at least 30 hours per week. At UNI, this includes any part-time hourly employee (including students, but excludes work-study assignment hours) and intermittent call-ins.

- Seasonal Employee – An employee who is short-term, temporary employment for true seasonal operations. At UNI, this would be limited to summer athletic camps and some academic summer camps. At UNI, seasonal employees would be eligible if they are expected to work full-time (average 30 hours per week) and for more than 90 days.

Measurement Periods

The Measurement Period "or look-back period" is a safe harbor method to provide employers the option to use a look-back measurement period of up to 12 consecutive calendar months to determine whether variable hour employees or seasonal employees are full-time employees (excludes work-study hours), without being subject to a payment under section 4980H for this period with respect to those employees.

ACA requires two categories of Measurement Periods:

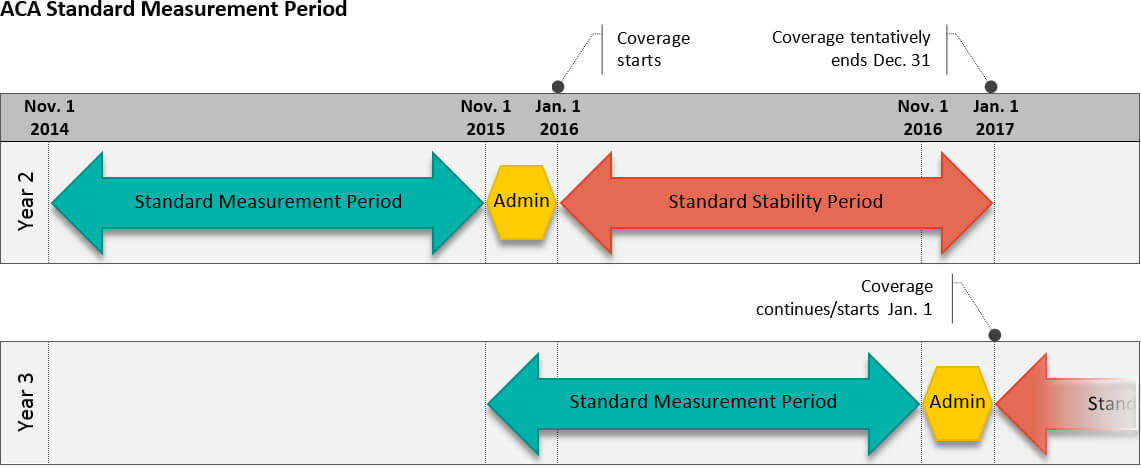

Standard Measurement Period

This applies for on-going employees who have completed one full Stability Period (see below). At UNI our Standard Measurement Period starts November 1 and ends October 31 of the following year.

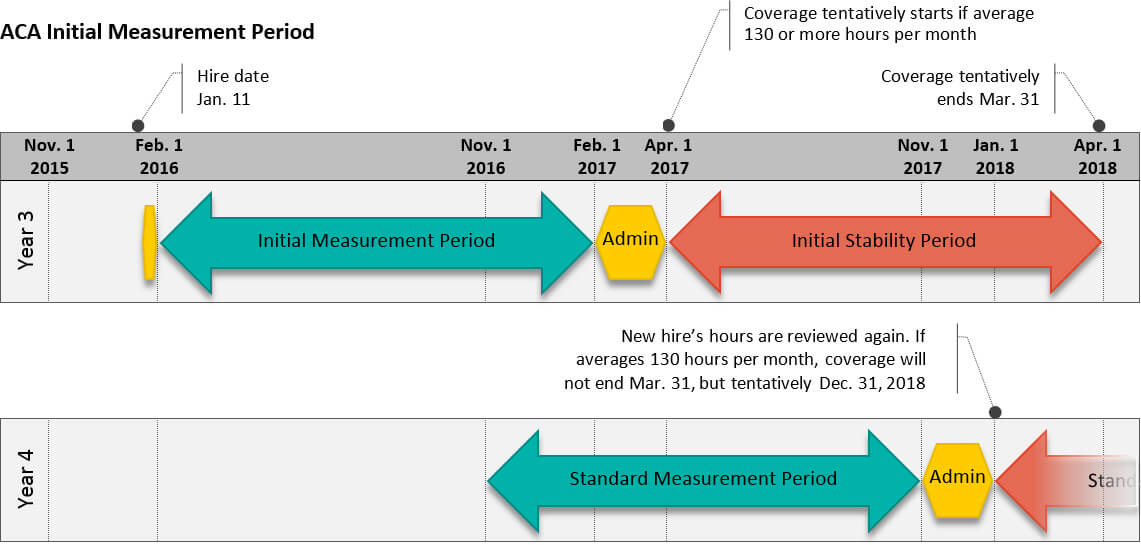

Initial Measurement Period

This applies for new employees starting the first of the month following their hire date and ends 12 months later.

Stability Periods

The period of time a variable hour employee that averaged 130 hours per month during the measurement period would be treated as a full-time employee regardless of the employee’s number of hours of service during the stability period, so long as they remained an employee (excludes work-study hours). The stability period cannot be less than the measurement period.

ACA requires two categories of Stability Periods:

Standard Stability Period

This applies for on-going employees. At UNI our Standard Stability Period starts January 1 and ends December 31 of the same year.

Initial Stability Period

This applies for new employees starting the fifteenth (15) month after the start of the Initial Measurement Period and ends 12 months later.

Administrative Period

The administrative period includes all periods between the latest start date of a new variable-hour or seasonal employee and the date the employee is first offered coverage under the employer’s group health plan. In addition, the period between the Measurement Period and the Stability Period (at UNI this period is two full months). This provides a period of time to evaluate eligibility and to complete the benefit enrollment process.

ACA Break-in-service Rules

ACA has very strict guidelines that must be used to determine average hours during the initial and standard measurement periods for all academic personnel, staff members and student employees.

Special Note: UNI’s implementation of breaks-in-service is lenient. For the purposes of ACA only, "break-in-service" is being defined as the period between the termination date and the latest start date. This practice is to ensure all employment groups with variable hours are treated equal. Therefore, when determining hours worked, only the weeks/months worked will be calculated in the average (i.e., weeks with zero hours will not be part of the average).

| Length of Break-in-service | Impact on Measurement/Stability Period |

|---|---|

| Break in service MORE than 26 consecutive weeks | Treat as new hire and Initial Measurement Period starts the first of the month following the return to work or rehire date. |

| Break in service between 4 – 26 weeks with amount of prior employment GREATER than break-in-service | Continue existing measurement & stability periods, but do not count break against employee (will average by smaller number of months to exclude the break-in-service). Special Note: If a previously non-temporary or ACA eligibility employee returns as a seasonal or intermittent call-in during the same Standard Stability Period, coverage does resume until the end of the current Standard Stability Period. |

| Break in service between 4 – 26 weeks with amount of prior employment LESS than break-in-service | Treat as new hire and Initial Measurement Period starts the first of the month following the return to work or rehire date. |

| LESS than 4 consecutive weeks | Continue existing measurement & stability periods. Factor in zero hours during the break |

Table 1

ACA Plan – To meet the ACA requirements, UNI is offering two new health insurance plans for employees who only meet one of the below ACA Eligibility Profiles.

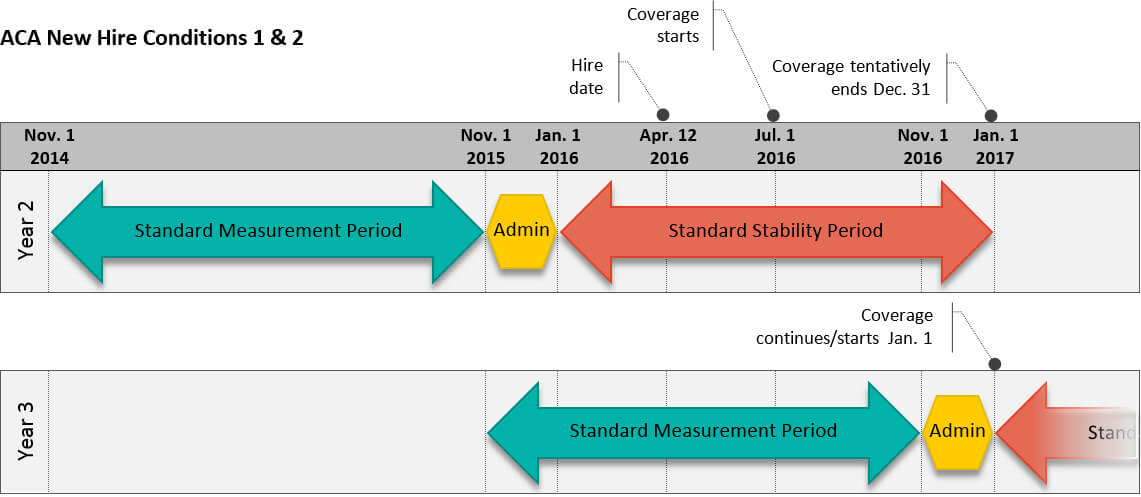

| Eligibility Profile 1 | Condition | Coverage Start Date | Coverage End Date |

|---|---|---|---|

| ACA New Hire Eligibility: Condition1 | Any employee (and is not a seasonal or intermittent call-in employee) who is reasonably expected to work full-time (average 30 hours per week) at his or her start date for 90 days or more is considered benefits eligible based on ACA rules. | For non-temporary employees, their coverage starts the first of the next month. For temporary employees, their coverage starts the first day of the third full calendar month after their [latest] hire date, unless they are new temporary faculty hired for half-time or more for nine months, then coverage begins the first day of the next month. | If during a Measurement Period full-time is not met, coverage will end at the end of the current Stability Period or the last day of the termination month – whichever comes first. |

| ACA New Hire Eligibility: Condition 2 | If a variable hour, part-time, seasonal or intermittent call-in employee has a break-in-service less than 26 weeks or break-in-service between 4 – 26 weeks with amount of prior employment GREATER than break-in-service they will be considered an on-going employee. | Their coverage starts the first day of the third full calendar month after their [latest] hire date. | The end of the current Standard Stability Period (December 31) or the last day of the termination month – whichever comes first. |

| |||

| Eligibility Profile 1 | Condition | Coverage Start Date | Coverage End Date |

|---|---|---|---|

| ACA Change in Hours Eligibility: Condition 1 | A variable hour or part-time employee who increases their assignment hours to 30 or more per week (or salaried employee increases to 75% or more). | The first day of the second full calendar month after the effective date change. Special Note: ACA requires coverage to start no later than 60 days of the effective date of the change, without facing a penalty. | If during a Measurement Period full-time is not met, coverage will end at the end of the current Stability Period or the last day of the termination month – whichever comes first. |

| ACA Change in Hours Eligibility: Condition 2 | A full-time employee, who has completed one year of employment (one measurement period) who decreases their weekly working hours from 30 or more to less than 20 hours and has elected coverage. | If currently enrolled in a non-ACA plan, the ACA plan will start the first day of the next month after the effective date change. If currently enrolled in an ACA plan, coverage will continue. | The end of the current Standard Stability Period (December 31) or the last day of the termination month – whichever comes first. |

| ACA Change in Hours Eligibility: Condition 3 | A full-time employee, who has not completed one year of employment (one measurement period) who decreases their weekly working hours from 30 or more to less than 20 hours and has elected coverage. | If currently enrolled in a non-ACA plan, the employee will be offered COBRA. | The end of the COBRA continuation period. |

| |||

| Eligibility Profile 3 | Condition | Coverage Start Date | Coverage End Date |

|---|---|---|---|

| ACA Standard Measurement Period Eligibility | During the Administrative Period, UNI will compile all non-work-study hours for all variable hour, seasonal and intermittent call-in employees and average their total monthly hours. All assignment timecards and salary data will be used. Anyone averaging 130 or more hours per month will be offered health insurance. | The start of the Standard Stability Period – January 1. | If during a Standard Measurement Period full-time is not met, coverage will end at the end of the current Standard Stability Period or the last day of the termination month – whichever comes first. |

| |||

| Eligibility Profile 4 | Condition | Coverage Start Date | Coverage End Date |

|---|---|---|---|

| ACA Initial Measurement Period Eligibility | During the new hire’s Administrative Period (starts the thirteenth month after the latest start date), UNI will compile all non-work-study hours for a new hire variable hour, seasonal and intermittent call-in employee and average their total monthly hours. All assignment timecards and salary data will be used. Anyone averaging 130 or more hours per month will be offered health insurance. | The start of the new hire’s Initial Stability Period – fifteen months after the last start date. | If during the Initial Measurement Period full-time is not met, coverage will end at the end of the current Initial Stability Period or the last day of the termination month – whichever comes first. |

New variable hour, seasonal and intermittent call-in employees are measured from the date of hire (i.e., first of the next month after the hire date) and may be measured simultaneously in both the Initial Measurement Period and the Standard Measurement Period.Note: If the new employee was determined to be full-time during the Initial Measurement Period, but part-time in the Standard Measurement Period, the employee would cease to be eligible for healthcare insurance at the end of the following Initial Stability Period. Conversely, if the new employee was determined to be part-time during the Initial Measurement Period, but full-time during the Standard Measurement Period, the employee would become eligible for healthcare insurance from the following Standard Stability Period. | |||

Taking a Closer Look

Non-Temporary Employee Coverage

Eligibility profiles for non-temporary employees who work half-time or more will not change. However, with ACA requirements they will now have an additional opportunity to maintain health insurance coverage if they were working 30 or more hours but then drop to less than 20 hours. In these cases, their current health insurance plan will end the effective date month, but the employee will have the option to enroll in an ACA plan. Coverage in the ACA plan will continue until the end of the current Standard Stability Period (December 31).

ACA health coverage for non-temporary employees reducing their work schedule below 20 hours a week.

Benefit overviews for new non-temporary employees working 50% or more (i.e., scheduled 20 or more hours a week).

Temporary Employee Coverage

Employee Specific Information

Implementation of the ACA – a history of specific actions completed for ACA compliance impacting employee benefits:

- Preventive services covered at 100%.

- Extended health coverage to dependents until age 26 regardless of marital status.

- Restrictions on over-the-counter reimbursements under the FSA.

- Maximum contribution under the Healthcare FSA limited to $3,050.

- Required Uniform Coverage Summaries.

- Inclusion of benefits value on W2 tax statement.

- Copays now included in the maximum out-of-pocket calculations.

- Required marketplace notifications in response to the individual mandate.

- Dependent social security numbers requested in preparation for IRS tax reporting.

- Form 1095 generated and mailed to employees started in 2016 for the 2015 tax preparation.

- Prescription copayments and deductibles are factored into and included in the maximum out-of-pocket calculations for the health plan.

Individual Mandate

If an individual already has health insurance through an employer-sponsored plan (such as the health insurance benefits UNI provides to benefits-eligible employees), Medicaid, Medicare, or private insurance, they can keep it. Another option is for an individual to purchase health insurance from the Health Insurance Marketplace, also known as the exchange, and possibly qualify for a subsidy. For more information on the options available to you, please visit www.healthcare.gov.

At UNI, the individual mandate is not considered a qualifying event to add coverage during the benefit plan year – coverage can be added during our open enrollment periods.

As part of the Affordable Care Act, individuals are now required to answer information regarding their health insurance coverage when filing their taxes. The plans offered by UNI meet the requirements for minimum essential coverage.

Employer IRS Reporting

As part of the Affordable Care Act (ACA), employers are required to provide the IRS 1095-C form to faculty and staff who were offered and/or are enrolled in employer health insurance in 2025. The university will provide the 2025 1095-C form electronically in UNI Works prior to the March 2, 2026 deadline.

The 1095-C form contains sensitive and confidential information about faculty and staff who were eligible for UNI health insurance in 2025, and if applicable, their dependent(s) who were enrolled in UNI health insurance during this time. Therefore to prevent mailing errors, please access UNI Works and elect the 'Receive electronic copy of 1095-C' option. Please view the 1095-C Form Job Aid for instructions.